Gold Coast In The"Start Of Recovery" Phase

It's incredible how much property information circulates each year as we approach the Christmas & New Year period.

This year has been no different with an extraordinary amount of statistics released that focus on what has transpired in the property market over 2023 and then projecting forward to what we may expect in 2024.

We have included a wealth of information for you this week but arguably the most telling is this week's HTW Valuers monthly report that has been published for the month of December.

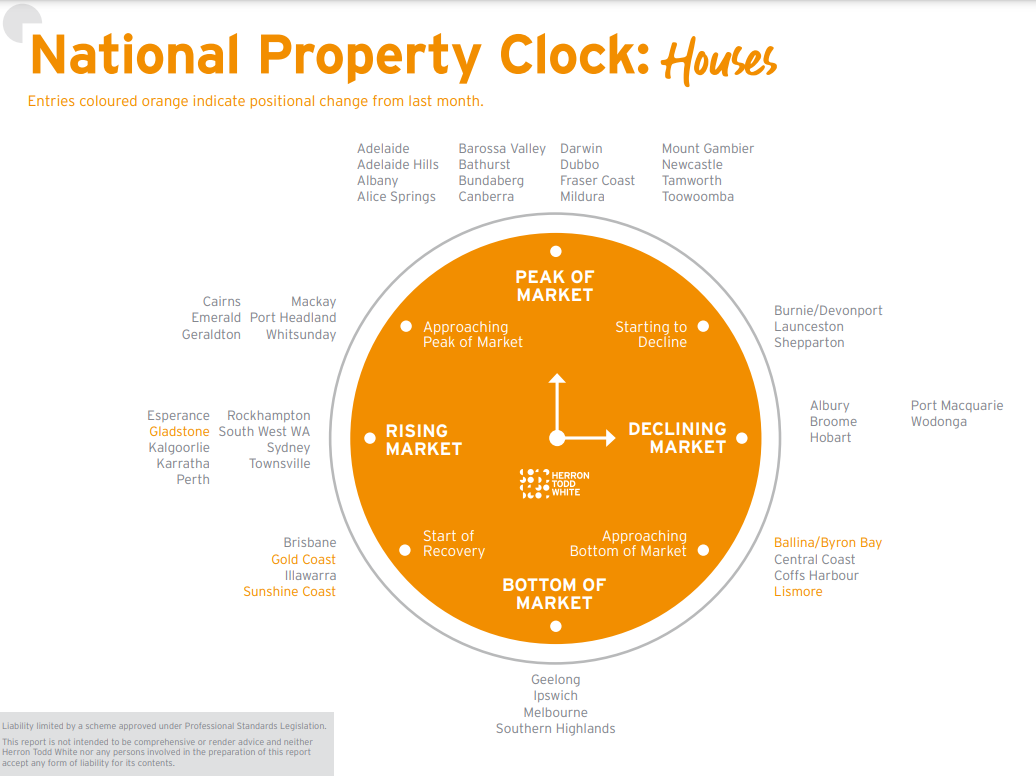

Whilst the report itself focuses on sentiment and trends from all areas around the country, the HTW property clock is relied upon Nationally for an insight into the markets future trajectory.

As you will see below, HTW has placed the Gold Coast property market firmly in the "Start of Recovery" phase in their property clock as we conclude 2023 and push towards 2024.

This is an extremely positive sign for the Gold Coast market as HTW Valuers have effectively declared that the Gold Coast market has only just begun its latest price growth phase with the promise of more to come.

With investment sales tipped to rise next year, the fact that HTW has included our market alongside Brisbane, the Sunshine Coast & the Illawarra region of NSW as being in the "Start of a recovery" phase ensures that a large portion of the investment sector will have their eyes firmly fixated on the Gold Coast property market in 2024.

Our lead article today in fact comes from HTW with an excerpt from their monthly report focussing on the Central Gold Coast region.

Whilst the various sales reported in this article does not paint the complete picture of our market, the sentiment contained in each sale listed suggests that prices have risen sharply in the back end of 2023 and that buyer demand is currently outstripping supply throughout the Central Gold Coast region.

This buyer demand is expected to continue into 2024 however it should be noted that if listing levels rise sharply as has recently occurred in the southern markets of Sydney and Melbourne, then price growth could very quickly begin to reverse.

This is a trend that every seller should be wary of.

Please see below HTW Gold Coast Central region recent sales commentary

Looking back to the beginning of 2023, the general consensus was that the Gold Coast residential market would likely continue on a downward trend throughout the year.

This was primarily based on likely further interest rate increases.

Looking at the current market at the end of 2023, the southern to central Gold Coast residential market is in better shape than anticipated.

Overall, the market has improved since the middle of the year with some strong sales results.

The main drivers for the market are stronger demand than supply which is being underpinned by continued interstate migration.

The volume of property listings and sales continues to be relatively low.

There has been an increase in value levels for properties in the under $1 million price bracket

1101/3 Main Street, Varsity Lakes recently sold for $477,500. It comprises a one-bedroom, one bathroom unit that previously sold in October 2021 for $380,500.

A three-bedroom townhouse at 19/8 Gooding Drive, Merrimac reportedly sold recently for $627,000 which is considered to be a strong sale price.

Another example of a strong sale price is 17/17 Great Southern Drive, Robina which sold for $890,000, being a three-bedroom townhouse with golf course views. Comparable sales suggest that this price was at the upper end of the range.

There is a four-bedroom townhouse at 24/28 Bonogin Road, Mudgeeraba that recently sold for $950,000, approximately $50,000 more than other 2023 sales in the complex.

There have also been some strong prices for properties in the $1 million to $2 million price bracket.

18 Constance Avenue, Mermaid Waters is currently under contract for $2 million, being a 10-year-old home on a dry block within 700 metres of the beach.

55/2 Third Avenue, Burleigh Heads sold recently for $1.82 million, which was a strong sale price. It comprises a partly renovated two-bedroom unit with ocean views.

27 Keel Court, Currumbin Waters sold recently for $1.95 million, which is a mainly original four-bedroom house on a 1,152 square metre canal-front allotment, which was considered to be at the upper end of the value range.

All of these sales indicate a stronger residential market than anticipated in the second half of 2023.

Please click to view the HTW Monthly National Valuers Full Report for December 2023.

Please see below HTW Valuers Property Clock for Houses - December 2023.

Please see below HTW Valuers Property Clock for Units - December 2023.