Distressed Listings Could Be On The Rise!

An article released on Friday in the AFR newspaper painted a bleak picture for our home suburb of Robina.

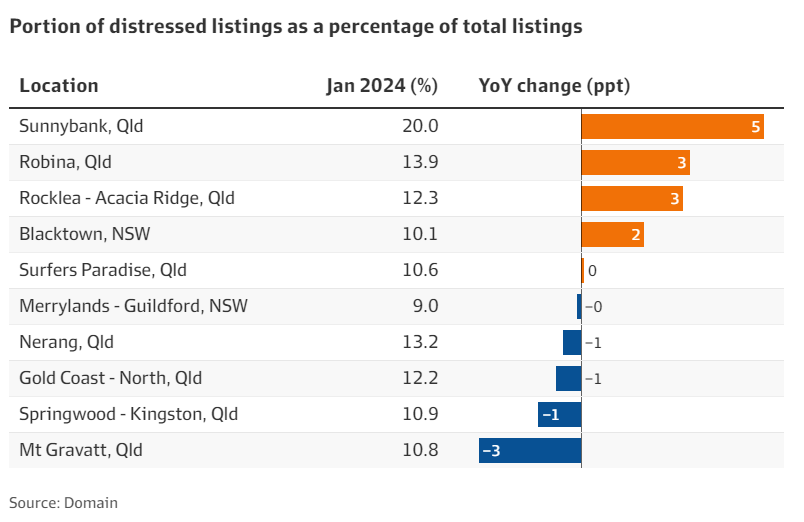

The article, " Distressed listings to rise if mortgage rates stay on hold this year" discusses mortgage stress and suggests that 13.9% of the new Robina listings that came to market in January were facing significant mortgage stress.

This is an incredibly high number and placed Robina second in the country when it came to mortgage stress and new listings to start 2024.

The full article is listed below however the thought of mortgage stress and the ramifications of more listings in the market led me to do some research to see if listing numbers on the Gold Coast were in fact starting to rise.

After reviewing the data, there are now clear signs that new listing numbers on the Gold Coast are rising at their fastest pace since the start of the pandemic and the impact that this emerging trend could have on house prices is significant.

A rise in new listings has in itself has been widely reported in the major southern markets of Sydney and Melbourne with a growing number of sellers reportedly either selling to take advantage of the strong current buyer pool or selling due to an increase in mortgage stress.

There are also a number of opportunistic sellers who have chosen to sell now based on the fact that buyers have limited choices and will therefore pay a premium for the right property that suits their needs, this has also been a strong trend here on the Gold Coast.

Regardless of the reason for selling, many recent sellers have had incredible results with the laws of supply and demand weighing heavily in their favour.

But this trend appears to be changing.

We wrote in this report just two weeks ago that new listing numbers in Sydney and Melbourne were up 11.9% to start 2024 when compared to the same time last year whilst new listings on the Gold Coast were in fact 6.1% lower than the same period last year.

To demonstrate how higher listing volumes can impact a market, the big auction cities of Sydney and Melbourne had very soft auction results yesterday with rising stock levels seeing clearance rates fall to 68% in Sydney and 64% in Melbourne where 70% to 75% clearance rates had been the norm throughout the back half of 2023.

The sharply rising number of new listings in Sydney and Melbourne has even led the ANZ to report on Friday that they have now downgraded their property price forecasts for both of these cities for the remainder of 2024.

So why is all of this relevant to us here on the Gold Coast?

Well, according to realestate.com.au, over the past two weeks new listings on the Gold Coast have increased by 9.1%.

These additional listing numbers provide buyers with more options and ultimately more choices and they also drastically reduce the amount of buyer competition for each home.

Whilst the last two weeks may be perceived as a small sample size, the flow on effects may be considerable with our own office data suggesting stronger listing volumes may be on the way.

As a business we have another twelve local residential listings going live tomorrow and our pipeline of new listings for the next month looks to be as strong as it has been for some time.

Will an anticipated increase in stock levels see yet another shift in momentum for Gold Coast property ?

Only time will tell.

If the AFR article on mortgage stress is any sort of indicator, listing numbers are likely to rise.

It also goes without saying that our need to show empathy and compassion with clients who face these challenges has never been more important.

Our lead article from the Australian Financial Review is below.

Distressed listings to surge if interest rates stay on hold this year

Distressed listings jumped sharply in pockets of Brisbane and Sydney over the past 12 months, with up to one in five homes listed under distressed conditions amid signs homeowners could be struggling to meet their mortgage repayments, new data shows.

The increase in particular suburbs contrasts with a broader trend as the proportion of distressed listings in the capital cities falls to its lowest level since before interest rates started rising.

But it is significant, say experts, who say some vendors in mortgage-heavy areas, particularly those that just came off fixed-rate mortgages, may have become desperate to offload their properties.

AMP chief economist Shane Oliver said distressed selling and mortgage delinquencies could start to rise strongly in the coming months if interest rates stayed at their current level this year.

“So far, most homeowners have been able to hang in there – evident in rising but still low delinquencies and distressed listings – because they have been able to rely on savings buffers, and the jobs market has been strong,” he said

“But with saving buffers for lower-income households looking like they are close to being depleted, and unemployment now clearly trending up, [that points] to rising delinquencies and distressed listings ahead unless the Reserve Bank of Australia soon starts cutting interest rates.

“While we think rates have peaked and will start to come down from mid-year, there is a high risk that rate cuts won’t start till later this year. If this is the case, I suspect delinquencies – like unemployment – will start to rise more aggressively, putting a lot more pressure on the property market.”

Rates, inflation starting to bite

Sunnybank district, 16 kilometres south-east of Brisbane’s CBD, had the highest level of distressed listings at 20 percent of all properties listed for sale in January. That was a 5.2 percentage point increase from a year ago, according to Domain.

The neighbouring district of Rocklea-Acacia Ridge also posted a sharp rise in the portion of properties selling under distressed conditions, lifting by 2.9 percentage points to 12.3 per cent.

Nicola Powell, Domain’s chief of research and economics, said the accumulation of rate rises and continuing high inflation might be hitting household budgets harder now than last year.

“I think for some people, that may be starting to bite particularly those that came off fixed-rate mortgages,” she said.

“Even though they’ve negotiated with their banks, the ongoing impacts of trying to balance the budget against high cost of living and higher mortgage repayments has become too much for some, so they’re selling up.”

Investors keen to sell

Brisbane buyer’s agent Zoran Solano of Hot Property Buyers Agency agreed that a lot of urgent sales were from people who were struggling to meet their repayments after rolling off their fixed mortgages.

“I’m getting at least two or three clients calling me about selling an investment property in the next six months, so there are certainly more urgent sellers now than six to 12 months ago,” he said.

“Most prospective sellers are investors with multiple properties that have fixed mortgages that just ended, and now they’re finding it tough to service the much bigger repayments so that’s where a lot of urgency is coming from.”

Urgent sales jumped by 3.1 percentage points to 13.2 per cent in Nerang on the Gold Coast and rose by 0.1 percentage point to 10.6 per cent in Surfers Paradise.

Separate analysis from SQM Research showed distressed listings rose sharply in Sydney suburbs Carlingford, Kellyville and Westmead in the past four weeks. There are now 15 distressed listings in Carlingford and Kellyville and 14 in Westmead.

“I think there is increasing fear and concern among property owners about when interest rates are going to fall. It might not come this year because the RBA, in my opinion, is on a slight tightening bias, so there’s no guarantee we will get a rate cut this year at this point in time. So we might see more distressed selling in the next few months as a result.”