First Quarter 2024

Today is the last day of the January to March quarter which represents an opportunity for us to review some early 2024 data.

With today being a Sunday, we can safely say that "live" listing numbers as they sit across the Gold Coast today will ultimately reflect the actual numbers when they are reported early in the week.

For the record, listing numbers have increased on the Gold Coast for the January to March 2024 quarter, but they have not increased anywhere near the volume that was predicted.

The Gold Coast as a region for example currently has an increase in new listings of just 171 new listings when compared to the same time last year.

Whilst results will vary from suburb to suburb, Robina was one area that actually had a decline in new listings when comparing the January to March period of 2023 v the same period in 2024.

Robina recorded 182 new listings for the January to March Quarter in 2023 as opposed to the 176 for the same period this year.

With our own open home numbers showing that buyer inspections to start 2024 are up by almost 35% on the corresponding time last year, the data certainly helps explain the increase in prices we have seen over the past few months.

For the full breakdown of Gold Coast and Robina listing numbers please see below.

Gold Coast - New Listing Numbers Per Quarter

Jan - Mar 2023 4801

Apr - Jun 2023 4762

Jul - Sep 2023 5144

Oct - Dec 2023 4699

Jan - Mar 2024 4972

Robina - New Listing Numbers Per Quarter

Jan - Mar 2023 182

Apr - Jun 2023 148

Jul - Sep 2023 180

Oct - Dec 2023 163

Jan - Mar 2024 176

We have also included various reports and statistical information for you this week that will hopefully give your clients a fantastic overview of current market conditions.

Our feature report this week is the latest HTW Valuers "month in review" that was released on Thursday Night.

It's interesting to note that the HTW Valuers property clock again suggests that the Gold Coast marketplace is still at the start of a recovery phase.

The HTW commentary this month focuses on investors. The extract from the Gold Coast as well as the Robina & Varsity Lakes areas are below followed by a link to the full report.

HTW Exert -

Gold Coast - Over the decades the Gold Coast residential property market has been known to be a rollercoaster ride for some investors, but is that now all in the past? Well, for starters, our city has become a much more sophisticated place, being underpinned by a strong local economy, and on top of that, the property market is also showing remarkable resilience of late. The recent levels of sales activity, booming migration, and the very tight rental market being experienced within our region are all influential factors that should provide investors with great buying confidence in 2024. These are all sound reasons why Gold Coast property would be one of the better options for investors at the moment, rather than buying in our other major capital cities.

With that said, let’s take a closer look at the investor market and highlight some of the recent trends that we have observed in the past few months.

Recent purchases of detached dwellings that we have noted have generally been limited to the more suburban areas rather than the inner suburbs and beachside localities. There has been sporadic investor activity in the suburbs of Robina and Varsity Lakes. Both of these areas are well serviced and rental demand for the family orientated home is high. Detached housing opportunities can be found priced between $900,000 and $1,100,000 that will typically achieve a rental income ranging between $1,100 and $1,400 per week. Traditionally, investors who are familiar with the area have gravitated towards the homes located within close proximity to Bond University or Robina Town Centre. The detached dwellings surrounding the university generally consist of three bedroom or four bedroom accommodation. Those properties which are leased out often achieve high rental returns with university students often content to pay a premium or above market rent where they can benefit from being within walking distance of the campus and don’t need to rely on using a vehicle.

Please click to view The full HTW Valuers month in review March 2024.

Please see below "My Housing Market" Quarterly House & Unit Price Update - As at 31st March 2024

Please see below the average income needed to afford a house in each capital city

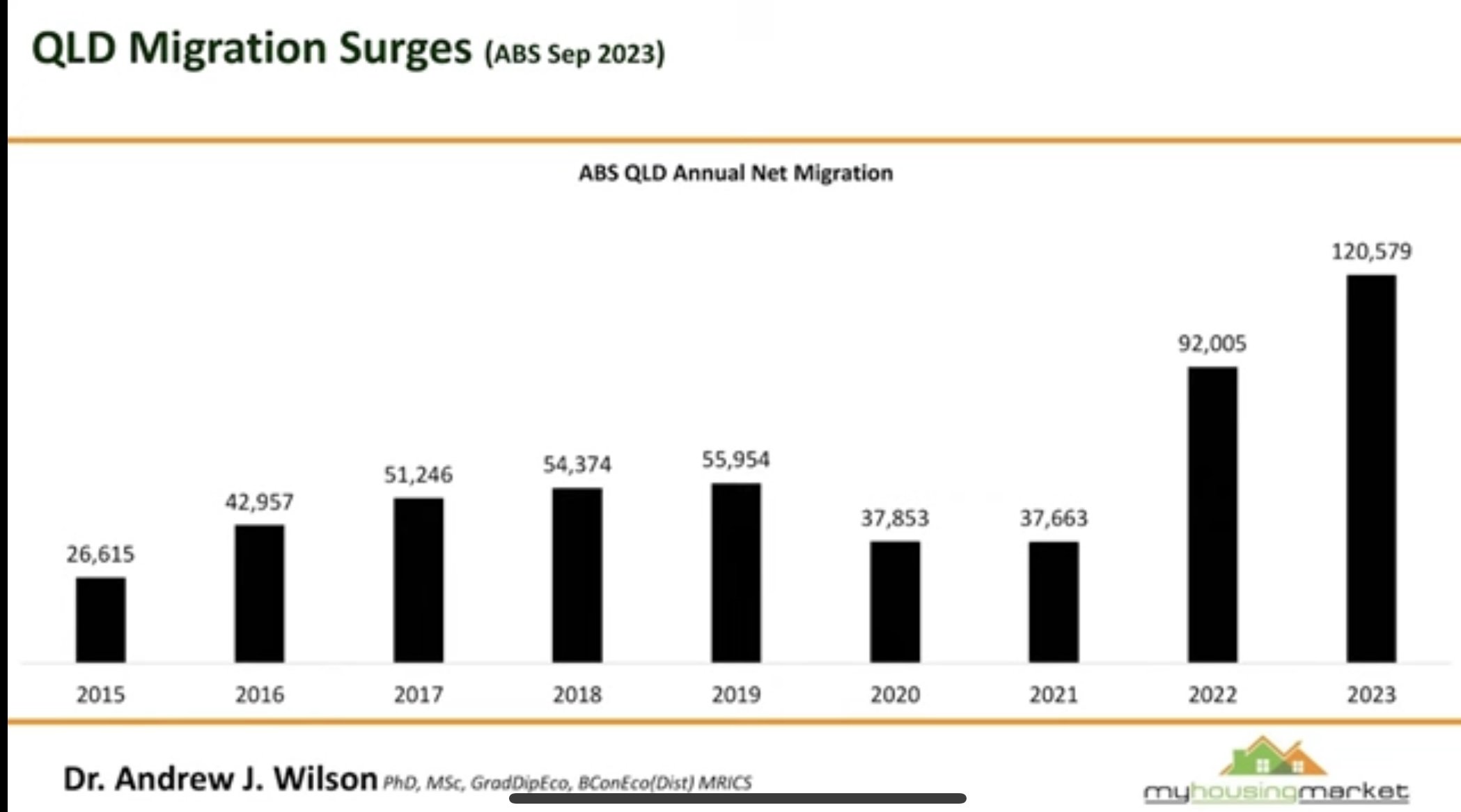

Please see below Qld's annual migration numbers aiding property price growth