The Property Market Has Gathered Pace!

With the first quarter of 2024 now behind us, clear patterns have emerged across the Gold Coast and the country that shows that the property market has gathered pace.

What has also become obvious is that an increased level of listing numbers across the country has failed to slow the price growth.

With this in mind, there are several pockets across the nation where stock levels have not increased in line with expectations.

The Gold Coast is one of those areas.

As we discussed last week, listings across the Gold Coast for the first three months of 2024 actually decreased when compared to 2023.

With the lower volume of listings and more buyer competition, prices on the Gold Coast are growing at a rapid pace as buyers compete against the backdrop of low listing levels.

Robina is a great example of current trends.

Saturday there were just 22 open homes in Robina as a suburb.

This is not just our office, it is all combined offices conducting just 22 open homes in Robina on Saturday.

This is an incredibly low number and if we consider that over the months of February and March our office alone sold 34 properties in Robina which came from over 1800 buyer inspections, it's easy to see why prices are rising sharply.

According to RP Data numbers released Saturday by Core Logic via the Gold Coast Bulletin, Robina house prices have increased by approx $50,000 over the past three months to the end of March. (Please see below ).

Whilst these numbers are strong, it is worth noting that many of the properties sold over the past three months are yet to settle or be recorded in government records.

Our own sales data in Robina suggests that prices are in fact significantly higher than Saturday's reported figures.

From our own sales, we can conclude that the median house price in Robina from the 19 house sales we sold over Feb-Mar was $1,320,000 - well over $100,000 above the reported suburb median.

Our median unit price was $860,000, again, considerably higher than Saturday's reported figure of $788,100.

Please remember that we sell approx 25% of all property in Robina so our sales data will be the most up to date and relevant in the marketplace today.

The last piece of information that should give potential sellers incredible confidence to list now is that currently on realestate.com.au there are just 28 houses available for sale in Robina when you take out those that are currently advertised as being under offer.

There are also just 36 units available for sale in Robina currently.

Again, these numbers are being mirrored across most suburbs on the Gold Coast, hence the price rises and the opportunities in front of sellers.

If you are talking to a potential seller, one has to ask, has there ever been a better time to sell?

Our feature story this week comes from research conducted by CoreLogic that was released this week

On track for another year of solid property price growth

New figures from CoreLogic show Australia’s residential property market is on track for another year of solid gains, despite a cost of living crisis, a per capita recession, and the highest interest rates in more than a decade.

CoreLogic's national Home Value Index (HVI) rose 0.6% in March, following a similar rise the previous month, and taking this year’s gains so far to 1.6%, in effect adding around $12,000 to the price of a median home, just since the 1st of January.

March was the 14th straight month of gains in housing prices.

If those monthly results continue to be replicated, Australia is on track to record growth of at least 6.5-7% this year, and that’s before an expected upswing in housing prices following forecast interest rate cuts in the second half of the year.

The nitty-gritty

Once again, CoreLogic’s monthly HVI figures show a mixed picture across the nation, ranging from a 0.2% easing in home prices in Darwin, to extremely strong monthly growth of 1.9% in Perth, 1.4% in Adelaide and 1.1% in Brisbane.

Growth was relatively subdued in Sydney at 0.3% in March, while there was no movement in Melbourne, which has actually seen home price growth go into negative territory (-0.2%) since the start of the year.

“The diversity in housing value outcomes can be explained by significant differences in factors like housing affordability, demand-side pressures from population growth and shortcomings in housing supply,” says CoreLogic’s Research Director Tim Lawless.

Pointing to the huge gains of just under 20% in home prices in Perth over the last 12 months, Mr Lawless says, “Despite such a rapid pace of capital gains, housing values remain relatively affordable compared with the larger capital cities.”

“Housing remains in short supply and purchasing demand is still high due to interstate and overseas migration rates that are well above average.”

Tim Lawless says recent population data from the Australian Bureau of Statistics showed net overseas migration to Western Australia was running well above average at 18,122 in the September quarter of last year (up from a decade average of 4,639 per quarter).

That’s been supplemented by net interstate migration, which is holding well above the previous decade average of -96, reaching 2,237 in the quarter.

“The extreme flip in demographic trends has delivered a significant positive demand shock across WA housing,” he says.

More broadly, CoreLogic’s research finds that the strongest housing growth conditions are now in the lowest quartile (or the cheapest 25% of homes on the market) across most capital city markets.

Across the combined capital cities, the lowest quartile home values increased by 3.1% in the first quarter of the year compared with a 0.7% rise across the upper quartile (or most expensive 25% of homes for sale).

“With housing affordability becoming more challenging and borrowing capacity lower than a year ago, it’s no surprise to see demand being skewed towards the middle-to-lower end of the value spectrum,” Mr Lawless said.

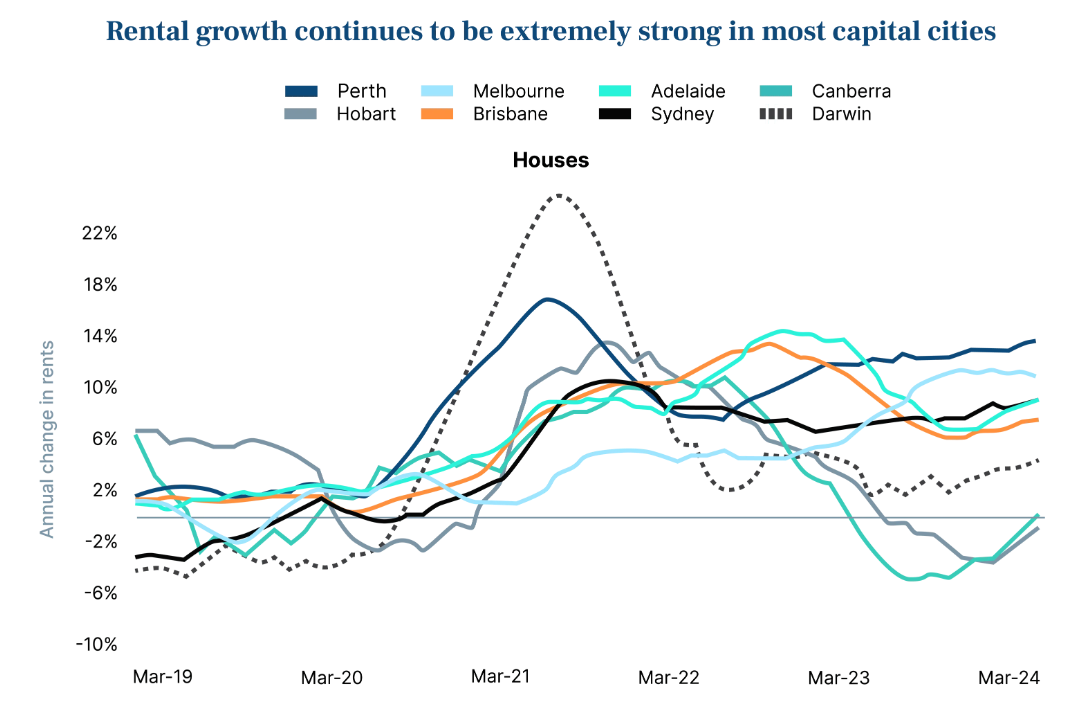

Investors take note: strong rental growth continues

CoreLogic now reports its national rental index was up 2.8% in the March quarter - that’s the fastest quarterly pace of rental growth since the three months ending May 2022 (2.9%).

It finds unit rents are continuing to rise faster than house rents across Australia’s combined capital cities, up 2.9% and 2.7%, respectively, in the March quarter.

With rents once again rising faster than housing values, CoreLogic’s Tim Lawless points to higher rental yields, which at 3.75%, are the highest since October 2019.

Interestingly, while home values in the Victorian capital have been sluggish, Tim Lawless says Melbourne has recorded one of the most significant lifts in gross rental yields, from 2.76% two years ago to reach 3.57% in March 2024, the highest gross yield in 8 years.

He says this can be attributed to a 4.1% fall in Melbourne dwelling values over the past two years, while rents in the southern city have surged 21.1% higher.

“A rise in rental yields alongside an expectation that housing values could rise and rental markets remain tight for an extended period of time is likely to be seen as an attractive opportunity for property investors,” Mr Lawless says.

Summary